International Taxation for US Expats: Navigating the Different Tax Laws

Posted on 23-03-2023 12:36 PM

The United States is one of the only countries in the world that taxes its citizens based on citizenship, not place of residency (Eritrea is the other).

However, some parts of US expats’ income may be eligible for exemptions and deductions. This can help reduce their overall tax burden, even when they are not living in the US.

Tax treaties

Expatriates who move abroad can benefit from the many tax treaties that the United States has with over 60 countries. These treaties aim to reduce the risk of double taxation and to provide a framework for communication and cooperation between the two countries involved.

While the specific details of a tax treaty will vary from one country to another, it is important to know the basics so that you can take advantage of these benefits. These benefits are often offered in the form of credits and deductions for various types of income, including dividends and interest.

A tax treaty may also allow you to exclude from US taxation certain types of income based on your residency or nationality, such as personal services income. This type of income is for work you perform on a regular basis in the host country, such as teaching or research.

Additionally, a tax treaty may allow you to claim a foreign earned income exclusion for up to $108,700 in 2021 (it will be adjusted for inflation each year). In addition, you can qualify for the Foreign Tax Credit (FTC) for certain types of international expenses.

You must complete a treaty-based return position disclosure when you apply for these benefits. The form requires that you certify your U.S. tax status to the foreign taxing authority and that you file your domestic and international tax returns.

Some tax treaties limit the amount of time you can claim a tax treaty exemption, particularly for international students and teachers. This can affect the amount of time you have to pay US taxes on your pension, Social Security and other benefits.

In addition to these tax treaties, there are other special tax laws for US expatriates that can be used to reduce your tax burden. These include the Foreign Earned Income Exclusion (FEIE) and the Housing Exclusion.

Using these special tax laws is a great way to reduce your US tax bill. However, if you are not sure whether these benefits are available for you or if you need help understanding the differences in the tax laws between the United States and your host country, it is best to consult with an expatriate tax professional who can guide you through the process.

Income tax

One of the most important issues to address for any American expat is income tax. There are many different types of income tax, and the taxes that apply to you can vary by country, jurisdiction, and your situation.

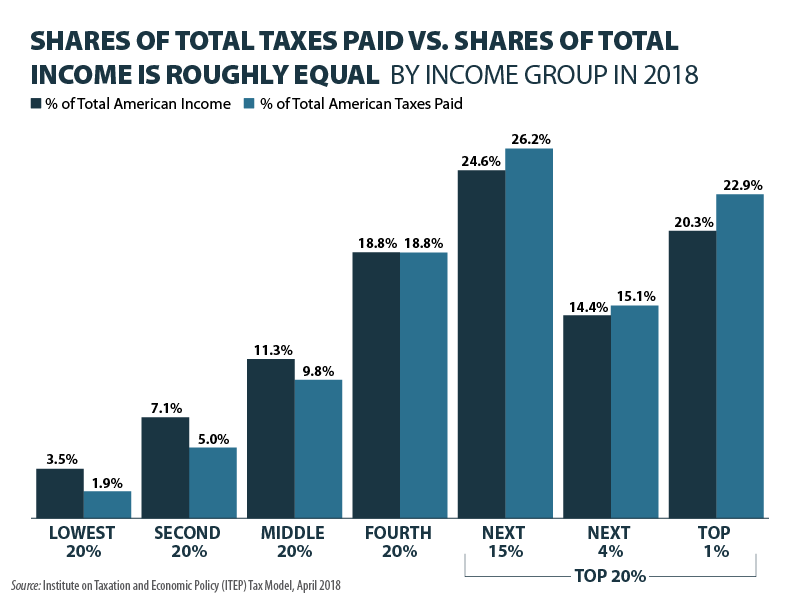

Most people will pay some form of income tax, but it’s important to understand how that works. The United States has a progressive tax system, meaning that higher-income earners will pay a higher rate than lower-income earners.

The IRS also has a series of exemptions and deductions that can help reduce your overall taxable income. Some of the most common include the Foreign Housing Exclusion and the Foreign Tax Credit.

These can be a great way to minimize your US taxes when you’re living abroad. However, it’s essential to talk with an experienced expat tax accountant before deciding which one is best for your situation.

As a US citizen, you’re required to file a federal tax return each year. You can choose to file online or in person. Filing online is typically more convenient, but it’s important to understand that you can miss a deadline and still need to file.

You can also use the Streamlined Procedure to catch up on your filings without penalties. This is a good option if you need to file for a couple of years but want a faster and more convenient process.

Another important part of expat tax compliance is FBAR reporting. This requires that you report your worldwide financial activity to the IRS. It’s especially important for those who have foreign accounts.

If you’re an expat who is self-employed, you will need to pay Social Security and Medicare taxes on your net profit. These are a bit different than wage earners in the US who withhold from their pay, but they’re a necessary part of maintaining your health insurance and retirement benefits.

You’ll also need to file an FBAR if you have any financial interest in or signature authority over foreign bank accounts. This can be a confusing task, and knowing the right forms to fill out is important.

Dividends

Dividends are a way for companies to give back a portion of their profits to shareholders. These dividends are typically paid quarterly or monthly and are a great way to receive extra income for your investments.

The amount of dividends that a company pays depends on how profitable it is and how long it has been in business. Generally, mature companies are more likely to pay dividends.

A company may also decide to skip paying a dividend in order to focus on growth or cover its costs. This decision can be a bad sign for investors. It is important to be selective when buying dividend stocks, especially if the company has a history of reducing or eliminating dividend payments.

It is also important to consider tax implications. In some countries, dividends are taxed at a lower rate than other types of income. This can be an incentive for investors in high tax brackets to invest in a company that pays dividends.

Most companies have a dividend policy that guides the size of their dividends, but the actual amount is voted on and approved by the board of directors. After the board votes on the amount, it officially declares the dividend on a date known as the declaration date.

Dividends are usually paid out as cash or stock. Cash dividends are money that the company sends out to shareholders in the form of a check. Shareholders can choose to sell the dividend shares for a profit or hold them until they receive their next payment.

Some companies may choose to use the money to expand the company, buy back stock or acquire another company. Others may choose to invest it in other projects, such as developing new products or hiring new employees.

When it comes to investing, it is always best to buy a quality stock that you believe in and that will grow over time. You can find out the yield on a stock by dividing its annual per-share dividend by the stock's price.

When you purchase a stock that is paying a dividend, be sure to buy it before the ex-dividend date (the date of the next dividend) or you will pay taxes on your full dividend amount when you sell the stock later on. This is known as the "bird in hand" theory. It is also a good idea to reinvest your dividends if possible, as this will help you to maintain a strong equity position for the long term.

Inheritance tax

Whether you receive an inheritance or are considering leaving an inheritance, it's important to understand the tax laws. This can help you avoid any unexpected taxes when you die.

Inheritance tax can be an important topic for US expats to consider because it can affect how they leave their assets to their family members. It also can have an impact on how much tax they pay on their income.

Many people choose to use gifting as a means of reducing or even eliminating estate tax liability. The IRS provides a generous annual gift exclusion that lets you give away up to $15,000 to each individual without triggering any taxes.

However, this does not mean you can't still owe estate tax on inherited assets. The IRS considers a variety of factors when assessing the estate liability, including how you're related to the deceased and what kind of assets you have.

It's crucial to consult an international tax CPA if you have questions about inheritance tax. These professionals can help you determine if your inheritance is subject to a tax in the country where you're living or whether you need to report it on an expat tax return in the United States.

A major issue with inheritance taxes is that they can vary widely from state to state, depending on the type of inheritance and who's receiving it. For example, in some states a 5% tax applies to inheritances larger than $2 million.

In addition, there may be a capital gains tax if the inheritor sells an asset. This could be a significant consideration, especially if the inherited assets appreciate in value during their lifetime.

When it comes to inheritance tax, the complexities can be overwhelming for US expats, so it's always a good idea to seek out professional advice. The Creative Planning International team can assist you in navigating the different tax laws and ensuring you get the most out of your assets.

For example, if you're an American expat living in the United Kingdom and have inherited an estate from a loved one who passed away there, you'll need to file IRS Form 706 within nine months of their passing. This form requires a variety of forms and documents, so it's best to hire an experienced tax CPA for American expats to help you navigate this complex situation.